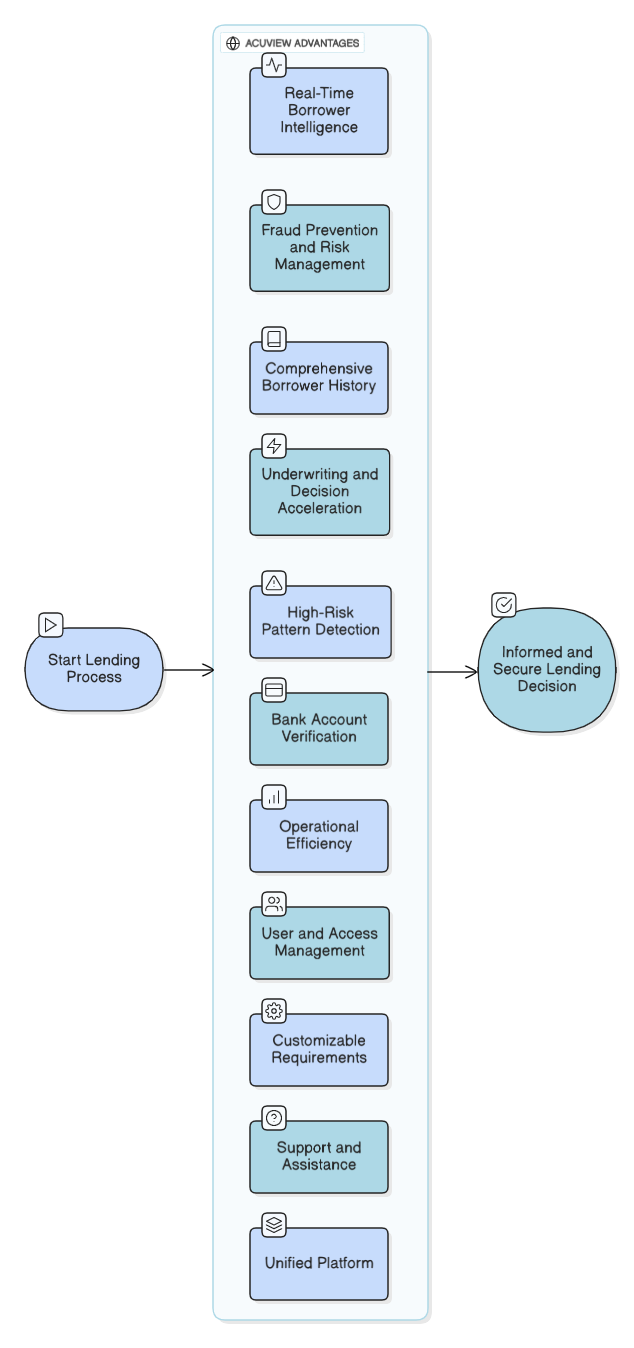

Advantages of AcuView

AcuView provides lenders with a unified, intelligence-driven platform designed to

simplify borrower verification, reduce risk, and accelerate loan review workflows. By

combining real-time borrower insights with automated checks and transparent loan history,

the platform helps lenders make more informed decisions while improving operational

efficiency. The following sections highlight the key advantages AcuView brings to your

lending workflow.

Real-Time Borrower Intelligence

AcuView delivers up-to-date borrower information the moment you search or verify an applicant. You can instantly see their most recent loan activity, application history, scoring metrics, and behavioral patterns. Having access to fresh, real-time data enables lenders to make decisions based on accurate information rather than relying on outdated reports or manual reviews.

Stronger Fraud Prevention and Identity Validation

With features like integration with AcuCheck, mismatch detection, bank account verification, and detailed borrower history, AcuView provides multiple layers of fraud protection. The system highlights inconsistencies, unusual activity, and potential risks before they impact your lending process. This reduces the likelihood of approving fraudulent applications and strengthens your overall risk management strategy.

Comprehensive Borrower History in One Place

AcuView consolidates all the past interactions with the borrower, including approvals, declines, written-off loans, and repayment behavior. This complete historical view helps you evaluate the long-term borrower reliability. Instead of piecing together information from separate systems, lenders can easily understand the borrower’s full lifecycle in a single report.

Simplified Review and Faster Decisions

AcuView provides built-in tools to approve, decline, or validate loan activity directly within the borrower report. Scoring weights and composite scoring further support decision-making by summarizing borrower behavior into clear, interpretable insights. This reduces manual review time and supports consistent evaluation practices across your organization.

Early Detection of High-Risk Borrowing Patterns

Through application analytics and period details, AcuView highlights short-term spikes in borrower activity, such as multiple applications within 48 hours or persistent applications spread across weeks or months or even years. These insights allow lenders to identify loan stacking behavior or signs of financial stress early, helping you avoid high-risk approvals.

Accurate Bank Account Verification

As AcuView offers bank verification, it ensures that the borrower’s account holder name, account number, and routing number are authentic. This reduces the risk of failed disbursements, fraudulent deposits, or incorrect repayment accounts. Verifying financial details prior to loan approval adds an extra layer of protection for the lenders.

Operational Efficiency for High-Volume Lending

AcuView supports bulk borrower uploads, advanced filtering, and fast borrower search, enabling lenders to process large volumes of applications without slowing down their workflow. These features reduce administrative effort, allowing your team to focus on decision-making rather than data entry.

User Management and Secure Access Controls

Administrators can add, edit, deactivate, or remove users through a dedicated Users screen. Access levels ensure that only authorized team members perform verification or defined actions. This helps maintain compliance, protects borrower data, and keeps your lending environment secure.

Customizable Borrower Information Requirements

The Settings screen in AcuView allows you to activate the exact fields your organization requires during application intake personal details, employment information, contact data, income and loan information, and bank details. You can also configure loan limits to ensure borrowers fall within your approved ranges. These settings help maintain consistent data collection and standardized rules across your team.

Clear Support Pathways

With the integrated AcuView Support widget, lenders can quickly access help resources or contact support whenever needed. This ensures that your team receives timely assistance during verification, borrower evaluation, or system navigation.

Reduces Dependency on Multiple Tools

AcuView brings verification, analytics, history, scoring, and bank validation into a single platform. Lenders no longer need to rely on separate systems or third-party tools to gather information. By centralizing everything, AcuView reduces complexity and improves visibility across the lending process.