Understanding the Borrower Verification Scenarios

AcuView’s verification engine evaluates each borrower through a combination of identity checks, historical analysis, behavioral insights, and fraud indicators. The result of this evaluation is presented as a Verification Scenario, which helps lenders understand how familiar AcuView is with the borrower, whether the information matches known records, and whether there are risks that need further review.

Each scenario represents a distinct level of certainty or concern regarding the borrower’s identity and activity. This chapter explains what each scenario means, how it is determined, and how lenders can use it to guide their verification decisions.

What Verification Means in AcuView

Verification is the process AcuView uses to confirm that the borrower is who they claim to be and that their submitted information aligns with records observed across the lending network.

- AcuView compares their personal, employment, income, and bank details with previously submitted data

- The system checks for inconsistencies, mismatches, or new patterns

- Borrower history, prior actions, and recency of applications are evaluated

- Application analytics (48 hours → 2 years) reveal behavioral trends

- Scoring weights contribute to a Composite Score

- Fraud intelligence is applied to adjust risk

Borrower Verification Scenarios

AcuView identifies borrowers using four scenarios. Each represents a different level of match, familiarity, or risk.

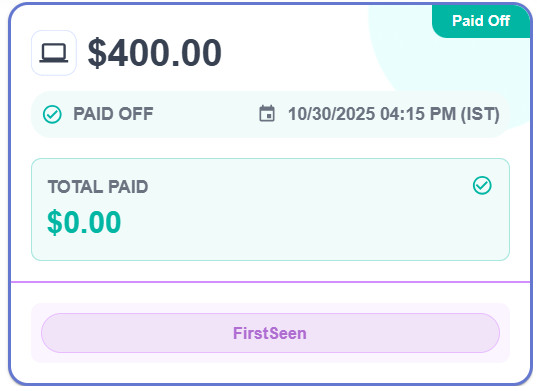

- The borrower’s identity is consistent

- Previously submitted information matches current input

- No signs of manipulation, conflict, or suspicious behavior

- The borrower has a reliable history in the system

How Lenders Should Interpret this?

A Match scenario typically indicates a low-risk borrower, especially when paired with strong scoring metrics and healthy application trends.

Typical Use Case

A repeat borrower applies with the same SSN, email, and demographic information that was previously approved and paid off.

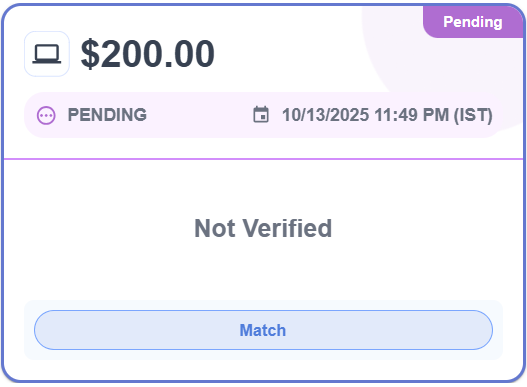

- The borrower is new to the AcuView lending network

- Verification relies solely on submitted information and bank validation

- There is no historical behavior or trend data

How Lenders Should Interpret this?

This scenario does not imply risk, only unfamiliarity. However, lenders should review bank verification and employment/income details thoroughly before approval.

Typical Use Case

A new customer applies for the first time with no prior lending history in AcuView.

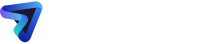

- Email address mismatch

- Address or employment discrepancies

- Inconsistent income figures

- Recency conflicts (e.g., sudden spike in applications)

- Details partially match previous submissions from the same borrower

How Lenders Should Interpret this?

This scenario implies moderate risk. Review all verification sections carefully especially AcuCheck, history, and scoring weights.

Typical Use Case

The borrower previously applied using a different email or slightly altered employment details.

- Major mismatch in SSN or demographic details

- Repeated failed bank verifications

- Suspicious repeat applications within short periods

- High volume of applications across multiple merchants

- Historically high default behavior

How Lenders Should Interpret this?

This is a high-risk scenario. AcuView recommends full document review, bank verification, and additional identity validation before taking action.

Typical Use Case

Borrower details differ significantly across multiple applications, suggesting potential identity manipulation.

Bank Verification Scenarios

In addition to borrower verification, AcuView validates bank information to ensure funds are deposited into a legitimate account.

Bank verification results fall into three scenarios:

- Scenario A: Match Found: The account holder name aligns with the SSN/name submitted in the application. This generally strengthens lender confidence in identity and reduces payment risk.

- Scenario B: No Match Found: AcuView cannot confirm that the provided name matches the bank account owner. Lenders should proceed cautiously and may choose to re-verify documents or request additional proof.

- Scenario C: Warning - Name Mismatch: The routing number and account number are valid, but the account holder name does not match application records. This does not always indicate fraud, but it requires additional verification (e.g., joint account, business account).

Real-World Examples of Verification Scenarios

Understanding how verification scenarios appear during actual lending situations helps lenders build intuition and confidence when working with different types of borrowers. These examples illustrate how scenarios emerge naturally during the verification process and how lenders interpret them before moving toward approval, denial, or further review.

A borrower who has previously taken a loan from your organization and repaid it successfully may apply again using the same SSN, email, and demographic information. When AcuView processes their application, all details match existing records exactly, resulting in a Match scenario. Because their history is consistent and their previous repayment behavior is positive, lenders typically view this scenario as low risk and proceed with minimal friction.

In another situation, a borrower may be entirely new to your organization and the AcuView network. When they submit their information, AcuView has no prior records to reference, creating a First Seen scenario. The lender must rely on information provided at the time of application, such as employment details, income information, and the results of bank verification. While this scenario does not signal risk, it requires lenders to build a fresh understanding of the borrower from available data.

A Warning scenario often arises when a borrower has some inconsistencies in the information submitted. For example, a borrower who previously applied with one email address may now use a different address, or their employment information may differ from earlier applications. These discrepancies do not necessarily imply fraudulent intent, but they do suggest that lenders should take a closer look at the borrower’s history and verify the accuracy of the new information before approving a loan.

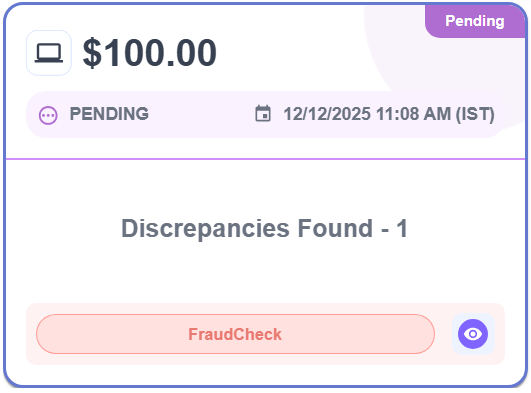

The most serious example involves a Fraud Check scenario. Consider a borrower who submits demographic and identity details that differ significantly from the past applications submitted under the same email or phone number. Alternatively, the borrower may show unusually high application frequency across multiple merchants within a very short period. In such cases, AcuView detects strong warning signs and presents them to the lender as a high-risk scenario. Lenders reviewing such cases typically delay approval until further manual verification is performed or may choose to deny the application outright if the inconsistencies indicate potential fraud.

These real-world examples demonstrate how verification scenarios guide lenders through the risk assessment process. By understanding why each scenario occurs and how it affects the accuracy of borrower information, lenders can make consistent, well-informed decisions that protect both their organization and their customers.