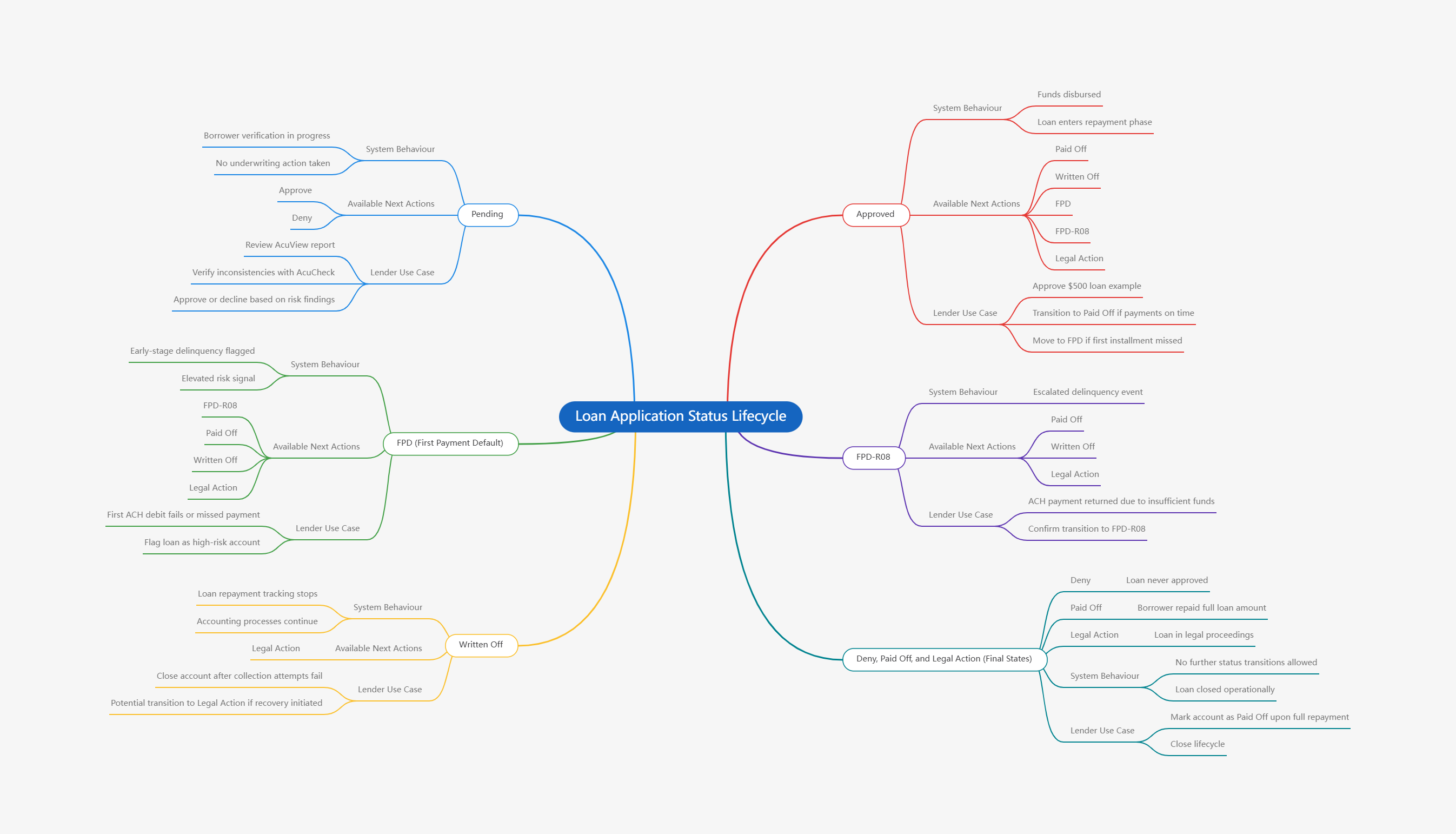

The Borrower Application Action Flow

AcuView uses a structured status-driven lifecycle to help lenders track borrower applications from the moment they enter the system until the loan is closed. Each status represents a specific stage in the lending process and determines which actions can be taken next. This predictable flow ensures consistent decision-making, improves internal reporting, and aligns all lenders on how borrower applications should progress.

The following sections describe each status, when it is used, and how it transitions. This model is similar to lifecycle documentation used in modern financial platforms, providing a clear and predictable understanding of how AcuView manages borrower activity.

Overview of the Application Lifecycle

Every borrower application in AcuView begins as Pending and moves through a series of well-defined states based on the lender actions and borrower behavior.

Application States and Transitions

Each sub-section below describes:

- What the status means

- When a loan enters this state

- Actions available from this state

- Typical lender use cases

Pending

The application is in pending when it has been submitted but not yet reviewed by the lender.

System Behaviour: Borrower verification may still be in progress. Lenders have not taken any action.

Available Next Actions: Approve, Deny

Lender Use Case: A borrower submits required data. You review their AcuView report, verify inconsistencies through AcuCheck, and choose to either approve the loan or decline it based on risk findings.

Approved

The status changes to approved when the lender has approved the borrower’s application.

System Behaviour: Funds may be disbursed, and the loan enters the repayment phase.

Available Next Actions: Paid Off, Written Off, FPD, FPD-R08, Legal Action

Lender Use Case: You approve a $500 loan. If the borrower pays on time, the loan eventually transitions to Paid Off. If the borrower misses their first installment, you may move the account to FPD.

FPD (First Payment Default)

The status changes to FPD when the borrower did not make the first scheduled payment after approval.

System Behaviour: The loan is marked as early-stage delinquent, signaling elevated risk.

Available Next Actions:FPD-R08, Paid Off, Written Off, Legal Action

Lender Use Case: The borrower’s first ACH debit fails or they do not make the payment by the due date. You flag the loan as FPD to track it as a high-risk account.

FPD-R08

This status is a result of a returned payment event occurred, typically an ACH return with an R08 code (during insufficient funds).

System Behaviour: The system treats this as an escalated delinquency event.

Available Next Actions: Paid Off, Written Off, Legal Action

Lender Use Case: You attempt to collect the first payment through ACH, but the bank returns it. This confirms insufficient funds and the loan transitions to FPD-R08.

Written Off

The status shows Written Off when, The lender has determined that the loan is no longer collectible.

System Behaviour:Loan repayment tracking stops. Accounting processes may run in the background.

Available Next Actions: Legal Action

Lender Use Case: After multiple failed attempts to contact or collect from the borrower, your organization closes the account as a loss. If legal recovery is later initiated, the loan transitions to Legal Action.

Deny, Paid Off, and Legal Action (Final States)

- Deny → If the loan was never approved.

- Paid Off → If the borrower fully repaid the loan.

- Legal Action → If the loan is now in legal proceedings.

System Behaviour: No further transitions are allowed. The loan is closed for operational purposes.

Lender Use Case: A borrower repays the total outstanding amount → the lender marks the account as Paid Off, completing the lifecycle.

| Current State | Allowed Transitions |

|---|---|

| Pending | Approve, Deny |

| Approved | Paid Off, Written Off, FPD, FPD-R08, Legal Action |

| FPD | FPD-R08, Paid Off, Written Off, Legal Action |

| FPD-R08 | Written Off, Paid Off, Legal Action |

| Written Off | Legal Action |

| Deny / Paid Off / Legal Action | Final (no transitions) |

Standard Successful Flow: Pending → Approved → Paid Off

High-Risk Borrower Flow: Pending → Approved → FPD → FPD-R08 → Written Off → Legal Action

Immediate Decline Flow: Pending → Deny